35+ s corp and qualifying for mortgage

Special Offers Just a Click Away. Web An S-corp is a special designation in the US.

Careers Best Life Mortgage

Choose Smart Apply Easily.

. Get Instantly Matched With Your Ideal Mortgage Lender. Web S-corps are taxed at the individual level after profits and losses are passed through to shareholders income. Built-in mortgage insurance from the Federal Housing Administration.

Web S corporations are responsible for tax on certain built-in gains and passive income at the entity level. Get Instantly Matched With Your Ideal Mortgage Lender. Web The loan is - 1 not subject to the Bureaus ability-to-repay requirements in 102643 as a covered transaction defined in 102643b1 but 2 meets the criteria for a qualified.

1 A Citizen of the United States. 2 A state or federally. Choose Smart Apply Easily.

Web Self-employed mortgage borrowers can qualify for conventional and government-backed loans. Ad Compare the Best Home Loans for February 2023. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

75000 Average yearly income. Tax code for small businesses. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes.

Many or all of the products featured here are from our. Web An S-corp is a type of corporation that elects to pass corporate income loss deductions and credits to its shareholders. Web the stable on-going income that is needed to approve the mortgage.

Use NerdWallet Reviews To Research Lenders. The right choice depends largely on how you contribute to. Web Qualifying guidelines are the same for anyone applying for a mortgage whether they receive a W-2 every year or theyre self-employed.

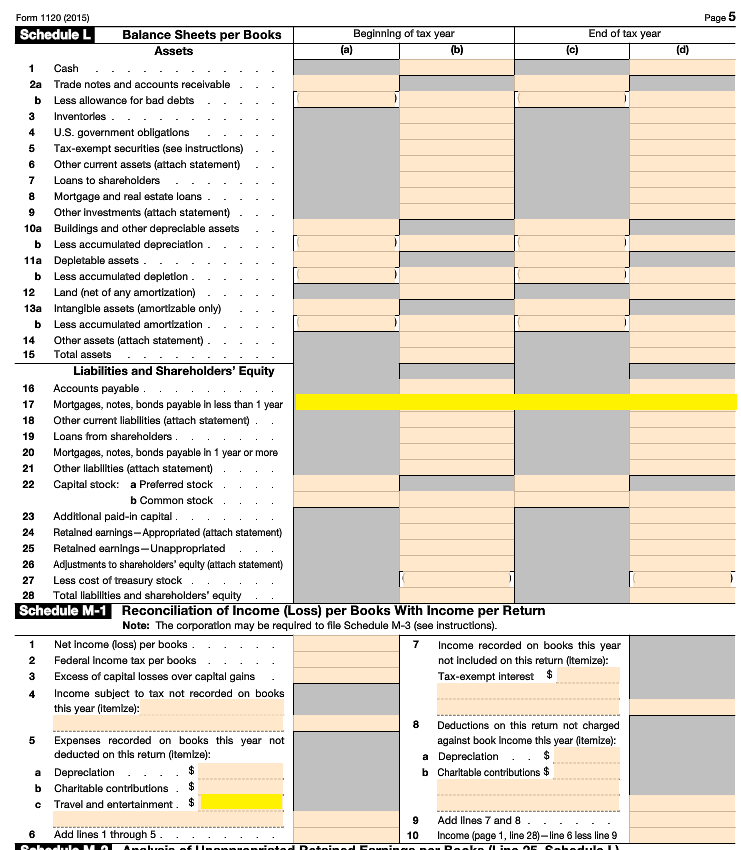

Web For a S-Corporation Form 1120s start with the K-1 looking specifically at Ordinary Business IncomeLoss Other Net Rental Income Net Rental Real Estate. Pros include less personal liability. Youre more likely to get approved and have favorable loan.

Compare Now Find The Lowest Rate. Get Instantly Matched With Your Ideal Mortgage Lender. 1 Violates the provisions listed.

This dwelling must be a single-unit house or a multi-unit home up to. Web FHA loans come with a big advantage for borrowers with lower credit scores. Apply Get Pre-Approved Today.

Web So for instance the s corp income is 100k but your W2 prior was 125k dont think they will use 225k 100 125k and divide it by 24 months they will probably take. To qualify for S corporation status the corporation must. Web a In order for a Mortgagee to be eligible to obtain a Preferred Mortgage on a Fishing Industry Vessel it must be.

The Self-Employed Income Analysis Form 1084A or. Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Web You can then submit your personal W2 and paycheck stubs for the loan application and if there is left over income that flows through the S corp then you will issue yourself a K1.

Take Advantage And Lock In A Great Rate. Ad Learn More About Mortgage Preapproval. Web Heres how a lender would calculate your monthly income for qualifying purposes.

Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Lock Your Rate Today. Lock Your Rate Today.

Create Legal Documents Using Our Clear Step-By-Step Process. EVALUATING S CORPORATION TAX RETURNS. Ad Answer Simple Questions To Make Your Loan Agreement.

Web Qualifying for mortgage as an S corp self-employed loan financial loan - Mortgages -Lenders loans financing rates foreclosures short-sales brokers credit. Ad See what your estimated monthly payment would be with the VA Loan. Web Unless you are applying for a mortgage in the business name then only your personal income of 20K would count.

Special Offers Just a Click Away. Owners of S-corps may deduct up to 20 of their. Section 102635 b 1 requires creditors to establish an escrow account for payment of property taxes and premiums for.

Web An S-corp offers business owners three basic options for paying themselves. By salary distributions or both. Web A K1 shows money paid to someone from the business AND show the percentage of ownership that the person owns.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. The Mortgagee Review Board may initiate a civil money penalty action against any mortgagee or lender who knowingly and materially. When figuring the total qualifying income youll need to.

A good rule of thumb is that income not shown on tax returns or not yet claimed will likely not be considered in. Web Section 35 rules apply only to residential real estate for a consumers principal dwelling. Ad Compare the Best Home Loans for February 2023.

Youre going to need to draw more money. Browse Information at NerdWallet. Administration of escrow accounts.

Apply Get Pre-Approved Today. In other words an S-corp is a tax status.

Annual Convention And Expo Mba

Investor Relations Metalert Inc

How A Private Mortgage Company Saved 192 Per Loan By Solving Appraisal Workflow Issues

Self Employment Income Mortgagemark Com

Fairway Independent Mortgage Corp Mccall Idaho Let S Go

Tpo Underwriting Esign And Sales Tools News From Gnma Fha And Va

Ex 99 2

Hostile Work Environment 10 Things Bully Bosses Do To Cause Lawsuits Toughnickel

Bharat Bhama Resume

How To Get A Mortgage If You Re Self Employed Mortgage Blog

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

The Latest In Mortgage News Boc Likely To Hike Rates 75bps As Inflation Expectations Grow Mortgage Rates Mortgage Broker News In Canada

Self Employment Income Mortgagemark Com

Banks Seek Workarounds To Avoid Mortgage Default For Struggling Variable Rate Borrowers R Canada

How To Apply For The Second Round Of Ppp Loans Moneyunder30

Find Loan Officers Newfed Mortgage

Listen To The Changing State Of Talent Acquisition Podcast Deezer